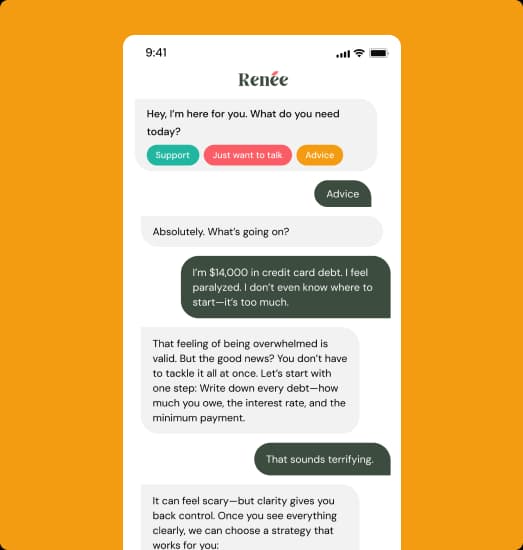

Your Emotional AI Support

The weight of debt can feel heavy, but there is a way out.

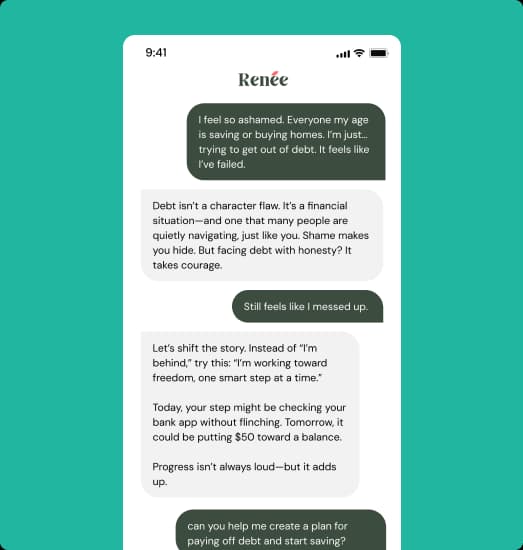

Being in debt can feel overwhelming, but it’s not a permanent situation. With the right strategies and mindset, you can take control of your finances and work your way to freedom. Renée offers clear, actionable advice to help you create a debt repayment plan, stick to it, and finally break free from financial stress.

Debt doesn’t have to be a lifelong burden. Renée can guide you step-by-step, from creating a realistic budget to identifying ways to pay down debt faster.

Create a budget

The first step in conquering debt is understanding your spending. Renée helps you create a budget that reflects your priorities, so you can start setting aside money for debt repayment.

Paying down debt strategically

Renée advises on the best strategies to help you focus your efforts on paying down the highest-interest debts first—or tackling smaller balances for quick wins.

Build an emergency fund

Renée emphasizes the importance of saving—even while in debt—so you don’t find yourself relying on credit cards again if an unexpected expense comes up.

Find extra income streams

Sometimes, getting out of debt requires a boost to your income. Renée suggests side gigs or other ways to supplement your earnings while you focus on debt repayment.